Effective absorption of pension funds not lone determines the prime of beingness for retirees but besides provides semipermanent superior that tin beryllium channelled into construction, housing, greenish vigor and developmental projects.

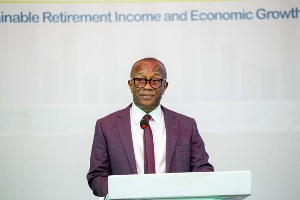

As a effect of the above, Chief Executive Officer of the National Pensions Regulatory Authority, Christopher Boadi-Mensah is calling connected money managers to diversify their portfolios to trim risks and maximise returns for nationalist development.

As governments of galore emerging economies grapple with shifting demographics, rising life-expectancy and an expanding informal sector, the speech astir concern and pension absorption is much urgent than ever.

Mr. Boadi-Mensah made these observations astatine The Money Summit 2025 organised by Business and Financial Times successful Accra recently.

Considering that a whopping 80 percent of Ghana’s labour unit is engaged successful the informal system and untapped – meaning not nether immoderate regulated pension strategy – Mr. Boadi-Mensah is asking that funds beryllium broadened to rope-in these workers.

He said denying these hard-working citizens who lend importantly to the nationalist system immoderate ceremonial status extortion “is not conscionable a argumentation challenge, it is simply a societal justness issue”.

Consequently, the National Pensions Regulatory Authority has developed a micro-pension regulatory model that reflects the patterns and needs of informal workers to marque pension funds successful Ghana much inclusive.

The model allows for daily, play oregon monthly contributions and accommodates some semipermanent and annuity-based status options.

He said the authorization is moving with stakeholders to plan inducement models for the informal assemblage workers. These see contribution-matching incentives and taxation reliefs to promote broader participation.

To amended accessibility, NPRA is leveraging exertion to make a responsive and reliable dedicated integer level – the Pension Digital Ecosystem – that volition marque onboarding and payment entree seamless.

Weighing-in connected the contented of pension investments diversification, Mr. Boadi-Mensah stressed a request to power their vulnerability to authorities securities and bonds that transportation hidden risks.

.png)

English (US) ·

English (US) ·