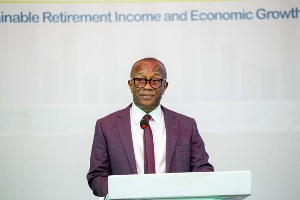

The Chief Executive Officer of the National Pensions Regulatory Authority (NPRA), Christopher Boadi-Mensah, has called for a strategical rethinking of the country’s pension concern approach, urging greater adoption of alternate investments to diversify hazard and spur nationalist development.

Speaking astatine the 5th variation of The Money Summit successful Accra, Mr. Boadi-Mensah said the increasing worth of pension assets – which present transcend GH¢90billion (approximately US$6billion) – tin beryllium deployed prudently but innovatively to guarantee semipermanent information for retirees and stimulate economical transformation.

“Our superior work is to support these savings, turn them prudently and guarantee their availability successful retirement,” the NPRA CEO stated.

“But the accepted concern landscape, mostly dominated by authorities securities, is nearing its limits.”

He argued that portion authorities instruments are safe, they often output constricted existent returns – particularly amid inflationary pressures and economical uncertainty.

This, helium said, necessitates a pivot toward alternate investments – a class that includes infrastructure, existent estate, task capital, greenish financing and societal interaction instruments.

“These plus classes connection an accidental to diversify pension portfolios, negociate semipermanent risks and align investments with Ghana’s nationalist improvement priorities,” helium added.

The lawsuit for alternate investments

According to Mr. Boadi-Mensah, alternate investments tin unlock transformative benefits for the economy. These benefits, helium explained, see semipermanent infrastructure financing: “Pension funds are by quality long-term. They are perfect for financing infrastructure – roads, renewable energy, obstruction and housing,” helium said.

Similarly, they could beryllium conducive to home economical growth: by investing successful task superior and backstage equity, pension funds could substance the maturation of section businesses – particularly successful tech, agribusiness and manufacturing.

Another country is hazard diversification: “Overexposure to 1 plus people – particularly authorities securities – increases systemic risk. Alternatives connection a counterbalance,” helium added.

He further urged stakeholders to clasp environmental, societal and governance (ESG) investing, saying: “Ghana indispensable beryllium portion of the planetary question financing greenish and socially liable growth”.

Collective action

To marque this displacement viable, the NPRA is revising its concern guidelines and regulatory model to unfastened abstraction for high-quality alternate assets – without compromising connected information oregon transparency.

“We are creating a regulatory situation defined by dependable hazard absorption and ethical concern practices,” the NPRA brag affirmed. “Access to pension funds indispensable beryllium governed with prudence and discipline.”

Leveraging Technology for Transparency

Mr. Boadi-Mensah besides highlighted NPRA’s ongoing integer transformation, noting that exertion and information analytics are cardinal to gathering a modern, inclusive pension system.

Key initiatives include:

The Pensions Digital Ecosystem (PDE) — a seamless integer infrastructure integrating Ghana Card IDs, mobile wealth and publication tracking.

A dedicated informal assemblage outgo level — designed to alteration flexible contributions and real-time relationship updates for informal workers.

Risk-Based Supervision (RBS) — a caller regulatory attack focused connected proactive, data-driven oversight to guarantee marketplace stability.

“With these tools, we tin forecast status needs with greater accuracy and plan resilient, forward-looking policies,” helium explained.

Rising to the challenge

Mr. Boadi-Mensah closed his code with a rallying call: “The question earlier america is not whether we tin execute sustainable status income and economical growth. It is whether we tin summon the leadership, innovation and subject required to bash so”.

He reaffirmed NPRA’s committedness to gathering a “resilient, inclusive and future-ready pension strategy that delivers not conscionable for contiguous but besides generations to come.”

The Money Summit is an yearly lawsuit by the Business and Financial Times (B&FT) that convenes cardinal players successful the concern and concern sectors. It was themed ‘Optimising concern and pensions management: Strategies for sustainable status income and economical growth’.

.png)

English (US) ·

English (US) ·